Tax evolution for 2022

Paris, 9th of February 2022

As 2022 begins, Arval Mobility Observatory is pleased to share with you a synthesis of changes to statutory taxation and the associated mechanisms evolutions in Europe, by country. As follows, you will find a non-exhaustive list highlighting the evolution of Governmental taxation, grants and bonus schemes for 2022 in some European countries (such as Belgium, Germany, Italy, Austria, Finland, Norway, Spain, the Netherlands and France) and the U.K.

Austria:

NoVA Tax:

In Austria, the government has introduced a tax change on the NoVA tax, effective from the 1st of January 2022, which concerns every newly registered vehicle (including motorcycles & quad bikes above 125 cm3). The NoVA is structured in two thresholds (grams/km of CO2 emissions); the first limit has been set at a 107g/km. The second limit or the “extra premium limit” has been set at 185g/km and is set to be reduced by 5 points every year. For every gram above the limit, you have to pay 60€ in premiums and the limit for the overall taxation has been raised to 60% at peak. When all this is calculated, you can deduct 350 Euros.

Road Tax:

Another tax change which will be effective in Austria, from January 2022, is the Road Tax change. This tax is paid on a monthly basis and is calculated based on the kW / power of the car and its CO2 emissions. As with the NoVA tax, the limits were reduced: CO2 is now at 109 (reduced by 3), and the kW deduction was reduced by 1, to 63.

Eco-Social Tax:

In addition to the two tax changes depicted above, a new carbon tax shall be introduced taking effectivity on the 1st of July 2022, the Eco-Social Tax. It aims at taxing fossil fuels consumption and will start with 30€/ton which will be increased annually (up to 55€/ton in 2025). For Petrol and Diesel, this means a 7-8 cents increase per liter. In return, a climate bonus will be allowed, ranging from a 100 to 200€ per year, depending on their geographical location.

BIK tax:

The Government have introduced a reduction of CO2 limit value for calculating the benefit-in-kind tax: if a car emits 135g/km or less in CO2, the driver pays 1.5% in BIK (720€ max.). If the car emits more than that, 2% are charged. BEVs and hydrogen cars are excluded from this.

Additionally, Austria introduced a Max. weight for BEVs: from March 2022, people with a driver license type B can now drive electric vehicles that weigh up to 4250 KG (instead of 3500KG).

E-vehicle & e-chargers bonus:

When buying e-vehicles, private individuals will continue to receive funding. Buying an e-car gives you 5000€, purchases of plug-in hybrids (with a fully electric range of at least 50 kilometers) are funded with 2500€. There are also discounts for private e-charging infrastructure: There are 600€ in funding for each intelligent charging cable.

Belgium:

Mobility budget:

As from 2022, the Belgian Government introduced some changes such as the simplification and expansion of the mobility budget. The waiting period required to be able to claim the mobility budget is abolished, it is no longer needed for a an employee to have had a company car (or the entitlement to it) for a certain period before being able to opt for the mobility budget. Additionally, an annual minimum (3 000€) and maximum (16 000€) has been introduced in the mobility budget. Here follows a list of some newly added costs types accepted in the mobility budget:

- Bicycles: financing costs (e.g. bicycle lease), storage costs as well as costs for non-mandatory equipment that increases safety or visibility

- Public transport: subscriptions for family members (residing with the employee) as well as parking costs associated with taking public transport

- Electric micro-mobility devices: cost for electric devices, such as electric steps, segways, etc. are now also allowed

- Pedestrian premium: a flat-rate pedestrian premium (of 0.24€/km) is introduced

- Housing costs: the radius for the inclusion of housing costs (interest, mortgage or rental charges) is extended from 5 km to 10 km from the place of employment

Charging stations grants:

Secondly, the Belgian government also introduced some tax incentives (for both private and professional) for the installation of charging stations:

For private individuals who invests in a so-called "smart" home charging station using green energy between 1 September 2021 and 31 December 2022 can count on a tax reduction of 45%. The maximum benefit will always be limited to 1500€ per charging station and per taxpayer. The condition for green energy will already be met if a contract is concluded for 100% green energy. The installation of solar panels is therefore not a requirement.

Companies will also be able to claim a tax incentive if they invest in a charging station, provided the necessary conditions are met. For investments made between 1 September 2021 and 31 December 2022, the fiscal deduction percentage is 200%. An important condition for companies is that the smart charging station must be publicly accessible during either the regular opening hours or the closing hours.

Denmark:

Benefit in kind tax:

As of 2021, the benefit in kind tax will be based on 25% of the car's value, up to DKK 300 000 (40 299.13€) and 20% of the part of the car's value that exceeds DKK 300 000 (40 299.13€). Additionally, an environmental fee of 150% of the green owner tax is added.

On the other hand, the 25% rate of the BIK’s calculation is to be reduced by 0,5% annually from 2021. The 20% rate of the car’s value that exceeds DKK 300 000 (40 299.13€) (in the BIK’s calculation), increases by 0,5% annually from 2021, so that from 2025 onwards, one rate set to 22.5% will be used. The environmental fee, which affects BIK tax, is increasing to 350% in 2022, against 250% last year (2021) and is set to increase to 450% in 2023, 600% in 2024 and 700% from 2025.

Phasing in for BEV and PHEV:

The phasing-in rate of electric cars will increase from the current 20% to 40% from 2021 until 2025. Or a 100% progression in only four years. From here, the phasing-in percentage will increase by 8% every year. By 2030, it will be 80%.

Basis deduction for all cars:

All cars are allocated a basic deduction of DKK 21 700 (2 914.97€). This basic deduction is also indexed in accordance with section 20 of the Personal Income Tax Act.

Additional basic deduction of DKK 50 000 (6 716.52€) for low-emission cars, which falls by DKK 2 500 (335.83€) per year towards 2025, and from here with a DKK 2 000€ (268.66€) deduction/year towards 2030.

Thus, the additional basic deduction for low-emission cars is DKK 45 000 (6 044.87€) in 2025 and DKK 35 000(4 701.57€) in 2030.

Additional basic deduction of DKK 170 000 (22 836.18€) for zero-emission cars, which falls by DKK 2 500 (335.83€) per year towards 2025, and from here with 617.92€ towards 2030. Thus, the additional basic deduction for zero-emission cars is DKK 160 000 (21 492.88€) in 2025 and DKK 137 000 (18 403.28€) in 2030.

Green owner tax:

The green owner tax is being reorganized so that it is based on CO2 emissions instead of fuel consumption. The green owner tax as we know today will increase yearly up to 2026 by 36%.

Motor vehicle tax:

- 2022: The motor vehicle tax is increased by 3.0 %.

- 2023-2025: The motor vehicle tax is increased by 6.5 % every year, i.e., in 2023, 2024, and 2025.

- 2026: The motor vehicle tax is increased by 10.0 %.

Finland:

Zero and low emission grant:

In Finland, the government introduced a tax deduction scheme for “zero and low emission” company cars. For EVs registrated from 2020 for the first time, the taxable value is reduced by 170€/month as well as a reduction of 120€/month from the operating costs in unlimited benefit.

For PHEVs, HEVs and CNG cars, vehicles with emissions which are from 1 to 100 grams/km (WLTP), the taxable value is reduced by 85€/month, if the company car is registrated from 2021 or later for the first time. There is an additional reduction of EUR 60 per month for Plug-in hybrid or CNG car from operating costs of unlimited benefit.

For every other fuel type (Diesel, Gasoline, etc…), the taxable value is reduced by 85€/month as well if the emissions are included in 1-100 grams/km (WLTP).

For EV’s private leasing there is also a EUR 2000 purchase support between 1.1.2022-31.3.2023 when the maximum value of the car is 50 000 eur.

Vehicle tax exemption:

The registration tax on zero emission cars will be abolished on 1 January. 2022 and the zero tax will be applied retroactively to cars first registered after 30 September 2021. The abolition of the car tax will reduce the taxable value of all electric cars registered for the first time after 30.9.2021.

E-van purchase bonus:

As from the 1st of January 2022, a governmental purchase support for full electric vans has been established. However, it is limited to 5pcs/company and from 2 000€ to 6 000€ per van depending on the vehicle weight. This support also applies to leased vehicles.

France:

While the 2022 Finance Law, published in the Official Journal of the 31 December 2021, does not changes the taxation on cars and mobility, several measures previously adopted by the executive entered into force on 1 January 2022.

Ecological malus:

This penalty is set to increase year by year since then until 2023.

From the 1st of January 2022, the threshold triggering the “malus” diminished to a 128 g CO²/km against a 133 g CO²/km in 2021 (123 g CO²/km in 2023).

The highest limit of the threshold is now set to 40 000€ from 224 g CO²/km and will reach 50 000€ from 225 g CO²/km. Since the 1st of January 2022, the “malus” is limited to 50% of the vehicle’s total price.

Weight malus:

From the 1st of January 2022, the vehicles which the weight of is higher or equal to 1 800 kg, will be taxed 10€ per kg exceeding this threshold. For anyone buying a vehicle disposing of 8 to 9 seats, a 400 kg ”discount” is allowed.

It is important to note that the cumuli of both “maluses” will be limited to the max limit of the threshold or 40 000€ in 2022 (50 000€ in 2023).

Handicap friendly vehicle’s exemption:

On the other hand, some exemptions exists for handicap friendly vehicles, people owning a mobility inclusion card and vehicles with electrical or hydrogen engines as well as PHEVs which can be driven 50 km in full electricity mode.

More information in French available here: https://mobility-observatory.arval.fr/fiscalite-des-flottes-et-des-mobilites-ce-qui-change-en-2022

Germany:

Plug-in-Hybrids: Halving the gross list price for taxation of the benefit in kind:

Purchase of a Plug-in-Hybrid car (by definition: vehicles which can be charged by an external plug):

- Purchase period: 1.1.2019 – 31.12.2021: carbon dioxide emissions max 50 g/km OR minimum electric range of 40 km

- Purchase period: 1.1.2022 – 31.12.2024: carbon dioxide emissions max 50 g/km OR minimum electric range of 60 km

- Purchase period: 1.1.2025 – 31.12.2030: carbon dioxide emissions max 50 g/km OR minimum electric range of 80 km

BUT: If vehicles are registered before 1.1.2019 or can’t fulfill the specifications, regulations before 1.1.2019 are applicable until 1.1.2023:

- Gross list price of the vehicle will be reduced per kWh capacity of the battery:

|

Registration Year |

Reduction amount in Euro per kWh of battery capacity |

Maximum Value in Euro |

|

2019 |

200 |

7.000 |

|

2020 |

150 |

6.500 |

|

2021 |

100 |

6.000 |

|

2022 |

50 |

5.000 |

As shown there will be a legal tightening for Plug-in-hybrid vehicles when purchased from 1.1.2022. The vehicle must either have a carbon dioxide emission of no more than 50 grams per kilometer driven or an electric range of at least 60 kilometers.

For Plug-in-hybrid vehicles purchased by end of 2021, nothing will change in 2022. However, compliance could become problematic, especially for newly acquired SUVs. The decisive factor is explicitly the acquisition and hand over date to the driver and not the time of ordering the vehicle.

The new federal government in Germany already announced changes in its coalition agreement of 24.11.2021: In the future, the privileged treatment of Plug-in-hybrid vehicles will only apply if the vehicle is predominantly (more than 50%) operated in purely electric drive. The minimum electric range of vehicles is to be raised again to 80 km as early as August 1st 2023.

Subsidy of charging infrastructure :

- KFW SUBSIDY 440 : Subsidy for private charging infrastructure at home: is currently expired

- KFW SUBSIDY 441: Subsidy for charging infrastructure at company properties:

- Subsidy of 900 Euro per charging point

- For the purchase and installation of charging points which are not publicly accessible

- To charge company vehicles and private vehicles of employees

- Maximum Subsidy per Location: 45.000€ (~50 charging points)

Italy:

Ecological bonus/malus:

Since the beginning of 2022, ecobonus/ecomalus (incentive/penalty scheme in purchasing) have been cancelled.

Netherlands:

BPM tax:

The BPM tax, which is the private motor vehicle and motorcycle tax, remains linked to CO² emissions and increases further. From 2022, the rate increases by 2.3% each year until 2025. How much BPM you have to pay depends on the category of your car and the BPM rate of this category.

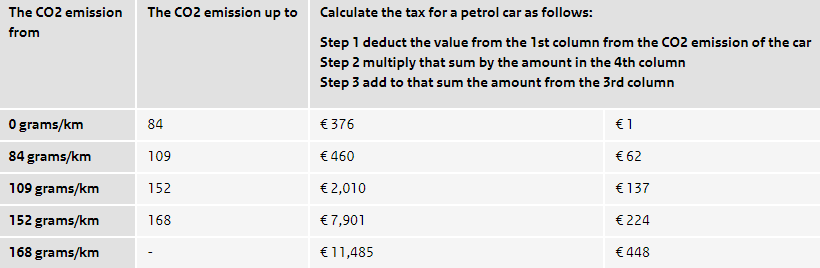

Combustion engine

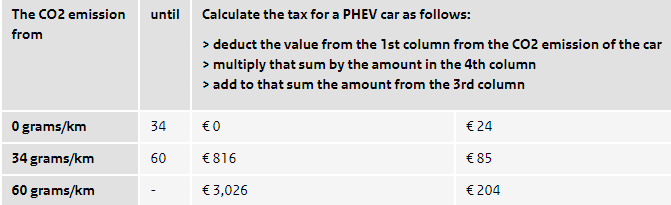

PHEVs

For fully electric cars, the BPM tax exemption will continue to exist until 2024.

For a delivery van, camper van or motorcycle you pay BPM over the net list price. The net list price is the list price minus the VAT. The BPM is also payable on extra options; for a delivery van, camper van or motorcycle you also pay BPM over the following extras included in the net list price:

- extra options

- accessories

- additional costs for special versions

BIK tax:

If the private use of the company car exceeds 500km a year, 22% of the vehicle’s catalogue value will be considered part of the driver’s/user’s income. There is a discount on this standard 22% rate for fuel efficient cars: instead of 22%, a 16% car benefit charge is levied if the car emits no CO2 (zero emissions vehicle) against 12% in 2021. The discount rate of 16% only applies to the first 35 000€ of the catalogue price. For an amount above 35 000€, the regular 22% must be paid. This threshold does not apply to hydrogen cars. If the private use of a company car is less than 500km a year, no car benefit is charged. Vehicles keep the tariff for a period that is the same as the standard lease period calculated from the moment the vehicle is registered for the first time. The ministry of finance has set the standard lease period at 60 months.

Individuals with a BEV have a lower percentage of the list price added to their income when using their company car also privately. For petrol cars this is 22%. For BEVs it was 4% in 2019, 8% in 2020, 12% in 2021 and has increased to 16% in 2022 and 17% in 2025.

Norway:

The main fiscal change in 2022 on company cars in Norway is a significant increase on the taxation of the benefit in kind on BEVs. Before BEVs were granted a reduction of 40% on the taxable value of the cars applied to calculate the benefit in kind. Since 1st January 2022, the reduction has been reduced to 20%. ICE / PHEV models don’t benefit from any reduction of the taxable value for the car.

Calculation of the taxable value for a company car in 2022:

This is the official price of the new car with the registration tax and VAT that is the basis to calculate the taxable value to be applied. Then different calculation rules apply depending it it’s a passenger cars or a LCV (called locally Class 2 vans)

Passenger car:

The taxable value results of the following calculation: 30% of the vehicle's list price with registration tax and VAT up to NOK 329,600 (32 786.47€) and 20% of the excess amount.

Example AMOUNT

New price of the car all taxes included NOK 600,000 (59 684.11€)

30% of NOK 329,600 NOK 98,880 (9 827.98€)

20% of NOK 270 400 (600 000-329 600) NOK 54,080 (5 379.53€)

Taxable value to be incorporated to the yearly revenue NOK 152,960 (15 127.47€)

At this taxable value a 20% discount will be granted if the car is a BEV so in such case the taxable value will become NOK 122.368 (12 172.38€)

Other discounts to the taxable value exist under the following circumstances and can be cumulative (these rules did already existing and remain unchanged in 2022):

- Cars older than 3 years are granted of a 25% discount

- Cars used for business trip over 40.000 km per year are granted a 25% discount

Spain:

Registration tax:

The registration tax scheme that is based on CO2 emissions in Spain, was modified in Q3 2021 up to the end of the year to neutralize WLTP impact and to mitigate covid-19 crisis effects in the automotive sector in the country. In January 2022, the registration tax is back to the original scheme affecting passenger cars which CO2 emissions are higher than 120 g/km.

Charging point property tax exemption:

Other fiscal incentives have been presented in January 2022 such as an exemption (up to 50%) on property tax for properties installing a charging point, same for businesses; Up to a 50% discount on Business Tax for local taxpayers installing charging points on the sites related to their business activity. Lastly, a 90% discount on building installations and other works tax for those works related to the installation of charging points. These incentives are pending to be approved and regulated by local authorities.

United Kingdom:

Fuel duty and grant rates for electrified vehicles (EVs, PHEVs, etc…):

In late October 2021, the Chancellor announced in his Autumn Statement that a planned 2.8p fuel duty rise would not happen and that fuel duty would remain frozen until 2023.

In December 2021, the Government cut the grant rates for plug-in cars and vans and changed the eligibility criteria as follows;

The Plug In car Grant which was previously set at a maximum of £2 500 (2 955.77€) has been reduced to a maximum of £1 500 (1 773.46€).Previously, cars with a recommended retail price of £35 000 (41 380€) or less were eligible for the plug-in car grant; this has now been reduced by £3 000 (3546.93€) to£32 000 (37833.87€) or less. Additionally, Hybrid vehicles including those whose CO² emissions were less than 50g/km and could travel a minimum of 70 miles with zero emissions will no longer be eligible.

For the Plug in Van Grant, small vans, those with a maximum of 2.5 tons Gross Vehicle Weight (GVW), the grant, which was previously set to a maximum of £3 000 (3546.93€), has now been reduced to £2 500 (2 955.77€). For larger vans, those with a GVW of 2.5 tons to 3.5 tons, the grant which had been up to a maximum of £6 000 (7 093.85€), has now been reduced to £5 000 (5 911.54€). For vans where the GVW is above 3.5 tons there has been no changes announced. Last but not least, businesses are limited to a total of 1 000 plug-in van and truck grants each year.

Home charging points grant:

Additionally, the government has announced that the Electric Home Charging Scheme (EVHS), that provides funding of up to £350 (413.81€) towards the cost of installing smart charging points at domestic properties, will no longer be available to homeowners who live in single-unit properties such as detached, semi-detached or terraced housing as of April 2022. The scheme will continue for homeowners who live in flats and people in rental accommodation (Flats and single-use properties).